NOW IS TIME TO SET YOUR GOALS

By now, you should have a handle on your spending habits, how much income you have and what you have to save each month. Hopefully, you have gone to your boss and maybe you have some more money in income from either a higher position or a raise. If not, it’s okay, we will be looking at additional ways to generate more money shortly. In order to get to the next step, you need to start putting a plan together for the following things:

- Pay off debt

- Create an emergency fund

- Start looking at investment opportunities

Ideally, you would be able to do all of the above at the same time, but I understand that if times are more difficult, it may be harder to do it all. As you review your finances and your monthly cashflow, you will be able to determine what you can spend and when.

PAY OFF YOUR DEBT

This is the most important aspect of wealth creation. Debt will simply drag you down. That said, there are different kinds of debt like credit cards, car payments, school loans and more. The trick here is that I am not saying you have to pay down ALL DEBT before you can start saving. If you have $25,000 in school debt, it would be great to pay it off immediately, but the interest rates on those loans might be less than what you would get in an investment.

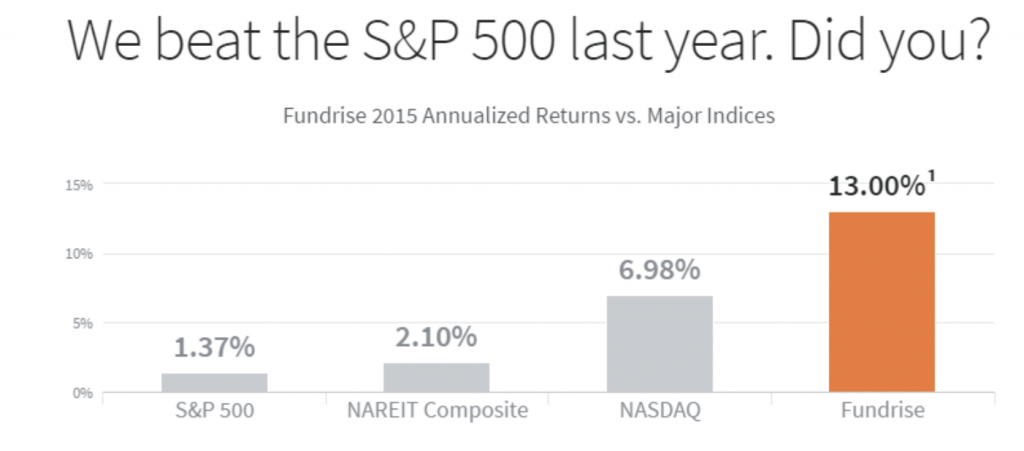

For example, assume you have a school loan at 4% interest and you are paying off the debt each month plus principal of that debt. Now, let’s assume you have an extra $100 per month. Then, assume there is a real estate investment fund that generates 6% interest. If you put that $100 into the real estate fund, it will generate more money for you than paying off that school loan.

So, what’s my point here? You need to organize your debt into the highest debt interest to the lowest. In general, I recommend:

- Get rid of your credit card debt first – with interest of around 17% – 25%. If you already have the mindset to get rid of your debt, here is an excellent trick! If you open a new credit card with a different company, many credit card companies will give new customers an interest free period of 6 months to 1 year on balance transfers. SO, if you move a $10,000 debt to a new account with no interest for one year, you can work on paying off that balance and pay ZERO interest. There is only one caveat. You have to cut up the first card. You CANNOT use both cards for buying more stuff!

- Car loan – ideally, you would be able to figure out how to pay off your car. According to Lending Tree, the average monthly car payment in the U.S. is $563 for new vehicles, $397 for used vehicles and $450 for leased vehicles. Overall, Americans owe nearly $1.4 trillion in auto loan debt. Auto debt makes up 5% of American consumer debt. You are here because you want to be different! Big Surprise – You don’t have to have a car payment. You don’t need to be like everyone else. To be wealthy, you need to make sacrifices and $563/month is a huge amount each month for many people. I personally had a car payment of $550/month. I paid down my car and refinanced the loan after two years and now I have less debt and a $320/month payment. My goal is to continue to pay down the debt until I have no payment and then use that original $550/month for investments.

- Other loans. Look at other loans you have and determine if it makes sense to pay off. I purchased a travel trailer with an $11,000 loan. The loan cost was “only” $110 per month. During the pandemic, I made it my mission to pay off all of the loans I could and get rid of any of the smaller loans I had. This is where most people get busted. The “only” $100/month for a trailer and “only” $40 per month for a Peloton membership and “only” $6 per month for another subscription. The next thing you know, you have “only” $500 in monthly payments. Get rid of the things you don’t use and subscriptions you don’t need.

- Mortgage loans. Most mortgage loans are now less than 4%. If you don’t have a loan lower than 4%, you better be on the phone right now with a mortgage lender to refinance your loan and save that monthly payment. Again, this is not a loan worth paying off since the rates are so low and your extra money can generate more money elsewhere (more on that later). Plus, you are getting a tax write off on the interest you are paying every year, so really the interest rate for most people is almost nothing.

ESTABLISH AN EMERGENCY FUND

The worst thing that can happen in your journey is an accident or an unexpected charge you weren’t expecting. An emergency fund is money that’s set aside for unplanned expenses, such as a medical bill, home repair or loss of income. Using emergency savings to cover unexpected expenses is better than paying with high-interest credit cards or taking out a new loan.

How do you start an emergency fund? The first step is to create a new bank account for the fund. An emergency fund needs to have enough money to cover 3-6 months of core expenses like monthly living expenses (home mortgage or rent), utilities, food and other necessities. In your cashflow analysis, you should have a good idea of what you spend each month.

THE POWER OF AUTOMATION

One of the great things about today’s society and technology is the power of automation. One thing we discussed here is the elimination of subscriptions. Well, why do you even have subscriptions? Because companies know that these are automated expenses that you just take for granted and pay because they are a pain to cancel and they are automated every month. Well, the beauty is that it goes both ways. There are a number of ways to automate your income savings. If you create a new bank account for your emergency fund, most banks like Chase bank have a feature that will allow you to transfer funds automatically every month from your main account to your emergency account. You create the setting, the amount to transfer and the date. I recommend creating the date on the day after you get your paycheck. I have automated settings to transfer $250 out of two monthly payments to a real estate fund account I am trying to build up to purchase real estate. It’s automatic and I don’t think about it, but I can tell it’s really cool every few months to see an extra $1,000 in that account.

On a more broad note, automation is what is going to make you wealthy. Going back to the Millionaire Mindset, at some point, you will have money making more for you while you sleep. WHAT? How is that possible? I’ll explain that in a bit, but this is what you need to understand now.

YOU PROBABLY SPEND WHAT YOU HAVE IN YOUR BANK ACCOUNT AT ANY GIVEN TIME! For example, if you make $5,500 per month and take home $4500 per month after taxes, you have to pay all of your bills out of that money. If your bills are:

- $1,250 rent

- $750 food

- $500 shopping

- $500 gas/car expenses

- $500 entertainment

- $500 credit card payments

- Total: $4,000

This leaves $500 left over. Most people’s first reaction would be “Cool. What can I spend an extra $500 on today?” If you look at these expenses above, a couple of things stand out. 1) this person has $4,000 in expenses each month. Does this person have $16,000 – $24,000 in emergency savings? 2) none of the money above is going to savings. This person is doing just fine spending $4,000 per month and getting everything they want and need. In this person’s case, I would suggest two things:

- Create an automated setting to move $250/month into the Emergency savings fund

- Use another $150 to pay off credit card debt until it’s zero (up to $650/month)

- Personally, I would use the last $100 to buy something extra.

Now, the FIRE movement people would tell you to move shopping to $100, food to $500 if possible, spend every extra dime on credit card payments and make entertainment close to zero. Like I said, I don’t think you want to miss out on everything in life to save every penny, but this is where your choices will determine how fast you climb the mountain. If you decrease your spending, move the payments over to your credit card and emergency savings, you could have that funded in 6-12 months. Otherwise, it could take longer. It’s up to you.

If the person above can cut expenses to the following:

- $1,000 rent

- $650 food

- $300 shopping

- $500 gas/car expenses

- $300 entertainment

- $500 credit card payments

- Total: $3,250

This would leave $1250/month left over. Once the credit cards are paid off, it would leave $1750 left over. Without making an extra dime, this person could put $1,000/month away, STILL HAVE $250 for expenses and fun left over and have an emergency fund funded within one year. By the way, with that extra $250 or other money, start using your debit cards to pay for things. You can’t keep racking up credit card debt. Using the debit card will control your spending.

Did this person make sacrifices? Yes. Maybe they moved into a smaller place and spent less on shopping and a little less on food. But at the end of one year, they would be protected in case of an unexpected event. More importantly, they would have a lot of extra money to start investing!

The biggest takeaway here is that you will not miss the money that is automatically moved to your savings account. You will adjust your living expenses and your spending habits to account for having less money from each check. The automation is truly out of mind as it just happens automatically. I understand that living paycheck to paycheck is hard, but I’ll tell you once you start seeing the money accumulate (and your Net Worth numbers start increasing), you will start adding to the automation. Got a raise? Add to the automation! This is where your journey will really start to accelerate.