One of the biggest reasons to start a business is due to the number to tax advantages you receive as a business owner. When you have a job, your taxes are taken out of your check immediately and, at the end of the year, you have to scramble to try and get some of that money back in your returns. Businesses take their gross income and then deduct all expenses and then you pay taxes on the profit afterwards. The key phrase here is “deduct all expenses” BEFORE you pay taxes. Your expenses in a business can include items that you would normally pay for after your W-2 earnings such as gas for your car, cell phone, meals or housing expenses.

TAX ADVANTAGES

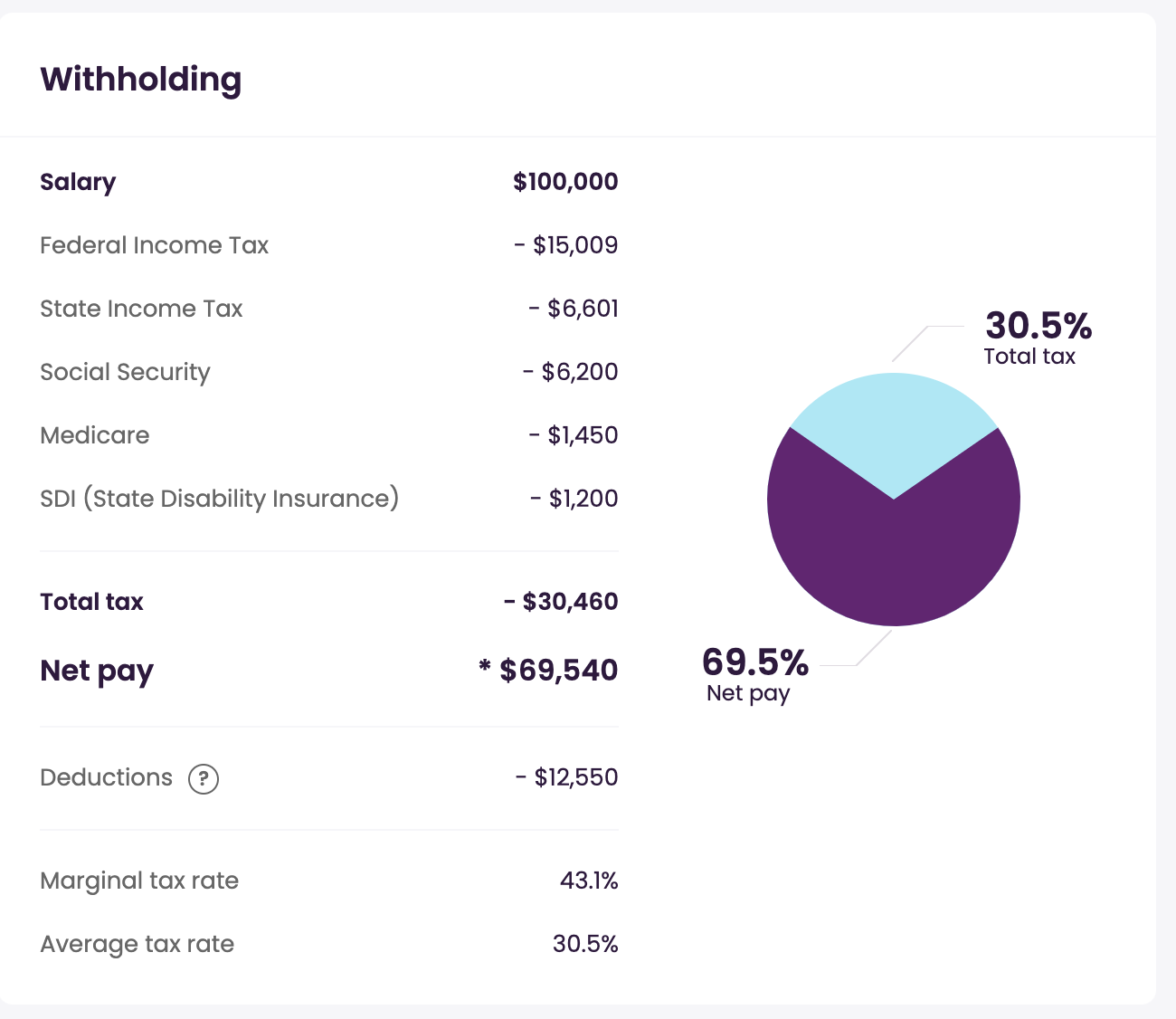

When you work for a company, that company gives you a W-2 worksheet that deducts upwards of 30% of your income from your check along with Social security and other expenses. The following is an example of someone in California making $100,000 per year and the typical deductions.

In this example, someone making $100,000/year only takes home $70,000 after taxes are taken out ($5800/month). Now, out of that $70,000, this person needs to pay for all of their personal expenses:

- Home – mortgage or rent ($2000/month)

- Car expenses – $500/month

- Cell Phone – $150/month

- Internet – $75/month

- Travel – $300/month

- Food – $1000/month

- Child care: $500/month

- Shopping: $500/month

- Total: $5025

This leaves about $800 left over. When you own a business, the government allows you to write off expenses for business after the income and THEN you pay taxes on your profit left over. So, in the example above, you are losing $30,000 immediately. That money is gone and goes right to the government. You’re left with 70% of what you earned and then you have to pay your expenses after that. How does this scenario work if you have a business.

Your business generates $100,000 a year in revenue. You pay $25,000 in expenses and marketing to run your business (assuming you are a web designer and you do all of the work). So that leaves $75,000 left over. Then, you use your phone for work, you pay for the car out of the company revenue as well as childcare and travel and food for clients. You can’t write off everything to the business, but let’s run some numbers:

- $75,000 left over after marketing costs for the business and outsourcing = $6250/month

- Travel (for work): $500/month

- Car paid for by company: $500/month

- Cell phone paid for by company: $150/month

- Meals paid for by company: $500/month (not all food can be written off)

- Child care: $500/month

- Shopping (you need outfits to meet clients): $300/month

- Total: $2450/month

- Balance: $3800/month

So, after you deduct all of your work related expenses, you are really only making $3800/month. If you multiply that by 12, you are making $45,600 taxable income to the government. In addition, you are able to deduct part of our house expenses where you work so let’s say 10% of house = $200 month tax write off from that expense and it lowers your yearly income to $43,200/year. In this example, you would probably drop to a lower tax bracket than the person making $100,000 year, but at 30% tax rate, you would owe the government $12,960/year.

So, your company generated $100,000 per year. Many expenses were paid by the company, your tax rate has been cut by more than half and the best part?