After you decide what you want to do for your business, the next steps including getting setup legally and for taxes to run your business. The first thing you need to know here is that you absolutely must separate your personal spending from your business spending. For accounting and tax purposes and for your business analysis, you need to know how much your business costs to run and how much money you are making to determine if you are losing money or making money. If you are adding things like shopping for toys for your kids to your business expenses, it’s very hard to see if your business is making any money. s

HOW DO I CREATE A BUSINESS ENTITY?

In order to split your finances between personal and business, you need to create a business entity. There are different types of business entities, but the most common are: Sole Proprietor, Limited Liability Corporation (LLC) and Corporation (S corp or C corp). The big difference between the sole proprietor and corporations is liability and who is responsible in case something goes wrong and your business is sued. If you are a sole proprietor and you get sued, the person suing you could include all of your personal belongings and assets in the lawsuit. For example, you start a business selling donuts. Someone eats one of your donuts and it gets stuck in their throat and they sue you because the donut was too hard. In this example, his medical bills cost $75.000. And yea, people pull that crap. As a sole proprietor, you could be personally liable for the $75,000 and might have to sell your house, your investments and car to pay that money back. If you have a really low risk business, maybe this isn’t a big deal and you can start as a sole proprietor, but if you are concerned about any type of lawsuit, I recommend you open an LLC.

A corporation is a type of business entity that protects your personal assets and becomes its own separate entity from your personal life. In this case, the corporation can get sued for any reason, but the person suing can only go after whatever assets the company has. If you run a service based company, the odds are that you don’t have a lot of assets and technically you could just say the company is bankrupt. Then, the person suing would get nothing. There is a higher cost for having a corporation, but the ability to shield your personal property and assets is a pretty big deal, especially if you have a house or stocks and investments.

DIFFERENCE BETWEEN LLC AND S CORPORATION AND C CORPORATION

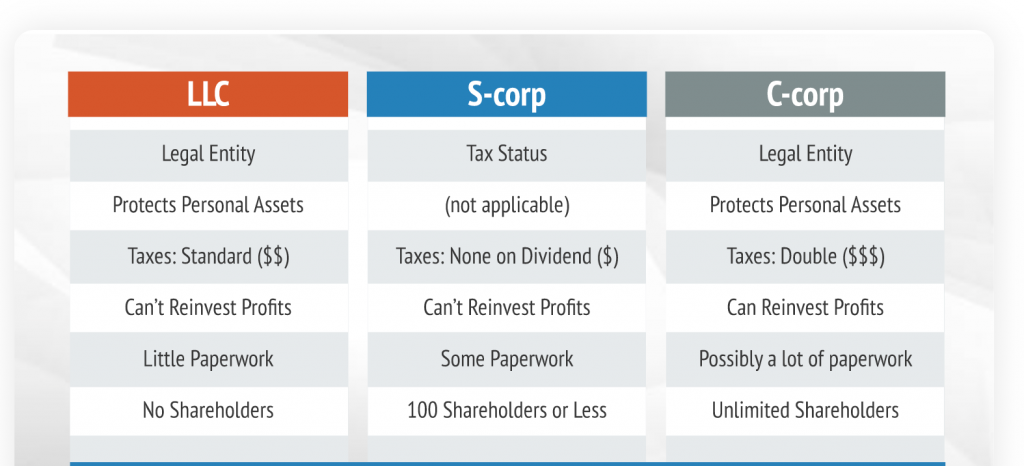

If you decide to set up a corporation, there are three different types: LLC, S corporation and C Corporation. An LLC is a low-maintenance legal entity that’s best for a simple business. An S corporation is a tax status created so that business owners can save money on taxes. A C corporation is a more complicated legal entity that’s best for businesses looking to keep profits in the business. The following graphic outlines the benefits and features of each type of Corporation Entity.

In order to determine the best entity for you, you should contact a Certified Public Accountant (CPA) and explain what you are doing and they can help define the best direction for you. If you change the entity type, you would have to changes your EIN number and other documents that could be a pain down the road. For my businesses, I have simply gone with LLC because they are easy to setup and the taxes at the end of the year are pretty easy to complete.

NEXT STEP: GET YOUR BUSINESS EIN NUMBER

Once you decide what entity you want to use for your business and you have a business name, the next step would be to get an Employer Identification Number (EIN) from the IRS. This is a specific number for your business that tells the IRS that you have a separate business and that the business will be responsible for filing separate taxes. Your EIN number for your business is like your personal social security number. It’s your business “social security” number you need to file taxes for your business. Getting an EIN number is really fast and cheap. Don’t pay an online service for this. Just go to the application here: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

LOCAL BIZ REQUIREMENTS

By this point, you should have your business name, your business entity type and your EIN number with the Federal government and IRS. You will need to register your business with three different local levels:

- State: Register your business name and entity

- County: Register a Fictitious Business Name

- City: Apply for a Business License

On a state level, you need to register your corporation with the state. Every state is different but it’s pretty simple to do a google search for your state and how to register a corporation name. Follow the instructions and fill out a form and there is usually a small fee associated.

On a local level, you will need to have to two items: a Fictitious Business and Business License. In order for cities and counties to make more money, most places will require you to get a fictitious business name. This is not a fake name, but a business name that you register at your county’s recorder office. Basically, it allows you to conduct business with your business name in your county. Most important, major banks like Chase require you to have a Fictitious Business Name to get a bank account.

On a city level, you will want to get a business license to conduct your business in the city you’re in. Almost every city requires businesses within their city to have a business license. This is a pretty easy process that includes a single form and a small fee. Most times, the fee is based on your yearly business income so, when you start out, the fees are small.

TIME TO GET YOUR BUSINESS BANK ACCOUNT

If you have all of the documentation above, you can go to a bank to get a business bank account. This is really important because this provides a way for you to separate your personal finances and business finances. As customers pay your business, that money goes into your business account and you or an accountant can then import all of your income and expenses into software that will breakdown everything you need to analyze your business. After 6 months to a year of running your business, you can print a very easy report that tells you how much money you are generating, what your expenses are and then your profit or loss on the business. With these reports, you can then tweak your spending, your marketing or find ways to increase your revenue to make more profits.